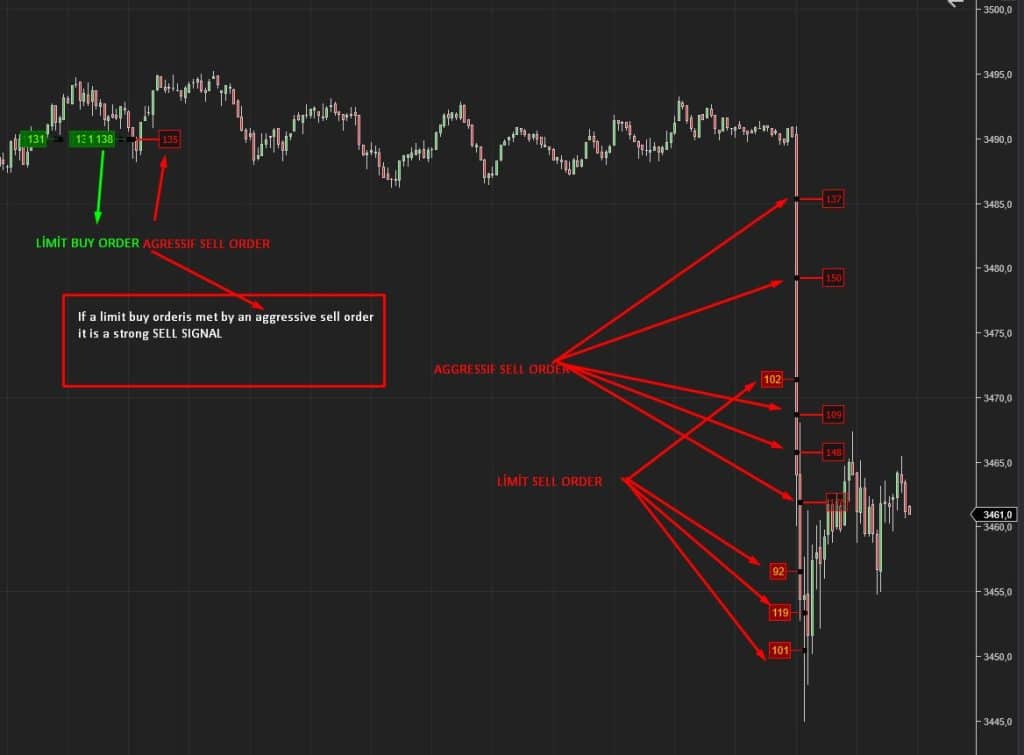

GC FUTURES

- At the price level of 138, a limit buy order was sitting.

- It was hit by an aggressive market sell order of 135 lots.

Interpretation:

- When limit buy orders are met with aggressive sell orders, this indicates strong selling pressure.

- Despite passive buying interest (limit buy), sellers are forcefully offloading positions, showing that buyers are not in control.

- This is a strong SELL signal.

Subsequent Activity:

- Multiple aggressive sell orders came in:

- 137 lots

- 150 lots

- 109 lots

- 148 lots

- 175 lots

- Additionally, limit sell orders were detected:

- 102 lots

- 92 lots

- 119 lots

- 101 lots

Conclusion:

- The continuation of aggressive selling after the initial signal at 138 confirms bearish momentum.

- The presence of stacked limit sell orders indicates strong resistance above, reducing the likelihood of upward movement.

- Combined, this validates a short entry opportunity based on order flow imbalance.

Yesterday, a 1044‑lot aggressive limit buy was detected at the 23 345 level on the Nasdaq — indicating strong short‑term buyer interest. My tape‑based filter marks a minimum threshold of 500 lots for similar activity in NQ and MNQ. Meanwhile, IBD shows strong breakout patterns in tech giants like Meta, Microsoft, Alphabet, and AppLovin. The Nasdaq Composite nearly reached record highs, boosted by Apple’s U.S. manufacturing pledge, and Fed rate‑cut expectations are supporting continued bullish sentiment. It’s also vital to monitor support at the 21‑day EMA for Nasdaq and the S&P 500 to guard against reversals.

ES FUTURES

At the 983 level, we saw a sharp aggressive buy—likely a significant market participant stepping in via aggressive lift orders. That push lifted price above the short-term congestion area, but then a retracement tested the zone again before finally breaking higher. The fact that price returned above that level and held suggests strong institutional participation and commitment—not just a one-off order sweep. It indicates demand absorption followed by strength and reveals that buyers are likely defending that level as support.

In essence, that aggressive buy triggered a structural shift: previous resistance turned into momentary support, and the fuel from those aggressive buyers helped drive price higher.

Last-Minute S&P 500 Insight from Investor’s Business Daily

According to the latest IBD commentary, the S&P 500 recently pulled back slightly (around –0.4 to 0.5 %) after a session that initially saw new record highs, as mixed earnings from major names like Amazon and Apple, and some caution around inflation data created volatility. Despite the dip, IBD still maintains a high exposure recommendation (80–100 %), suggesting the uptrend remains intact and healthy

No comment yet, add your voice below!