The VPOC (Volume Point of Control) is a classic tool in any volume trader’s arsenal — but this version takes it beyond the standard.While traditional VPOC indicators rely on static formulas and fixed levels

Continue readingMaxFO – Pre-Market Fakeout Detector for Early Entry Opportunities

MaxFO (Máximo de Fake) is a specialized indicator designed to detect fakeouts during the U.S. pre-market session, giving traders a structured way to anticipate false moves and time their entries on the first real impulse.

Continue readingEsperanzag – Advanced Price Leg Analyzer & Market Symmetry Tool

Esperanzag (pronounced: “Esperanza-graph”) is an advanced price leg dissection indicator that helps traders understand the true internal structure of market moves.

Continue readingDynamic Support Resistance – Adaptive Market Structure in Real Time

The Dynamic Support Resistance indicator is designed for traders who need their levels to move with the market, not lag behind it. Originally developed for algorithmic trading, this tool dynamically updates based on a custom formula that blends price and volume behavior.

Continue readingCandle POC – Micro Volume Profiling, One Candle at a Time

Candle POC is a lightweight but powerful indicator that gives you a precise view into how volume is distributed inside each individual candle on your chart.By plotting the Point of Control (POC) for every candle as a clean yellow line

Continue readingBilliard Bands – AI-Based Price Line

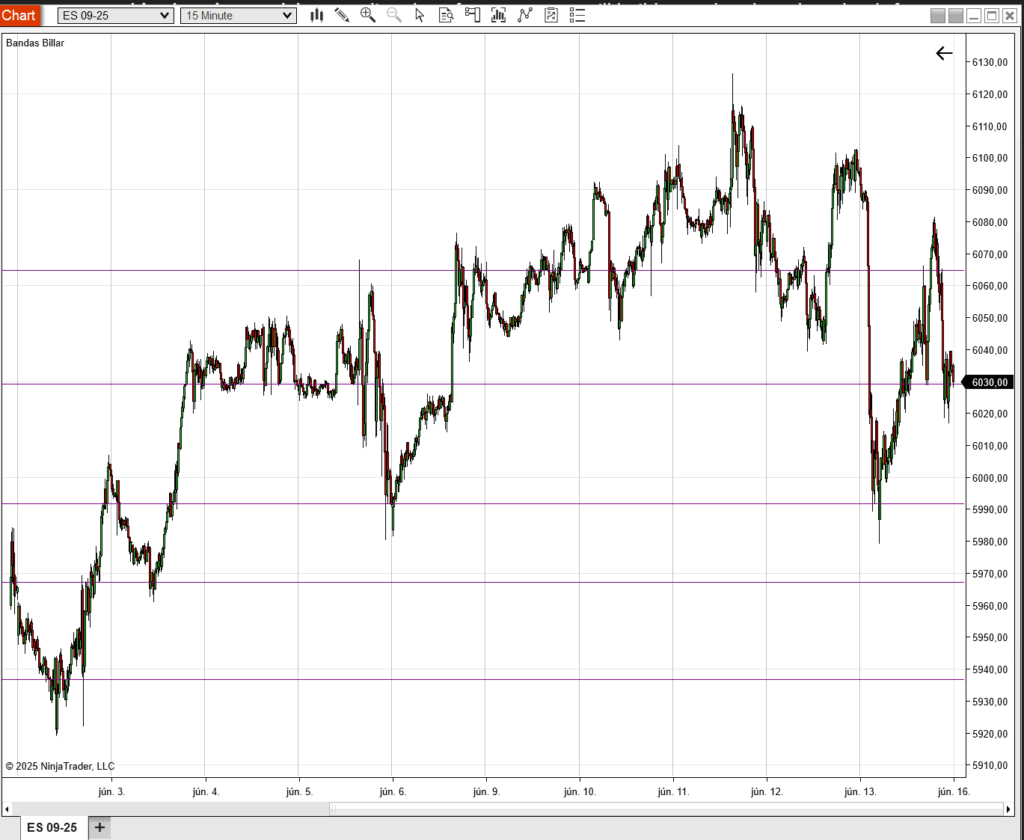

Billiard Bands is a unique indicator that blends price structure with artificial intelligence to replicate the way Basque trader Baiazuri draws key price levels manually — now automated, efficient, and real-time.

This tool isn’t about general support/resistance — it’s about precision. The indicator highlights the exact price levels where previous market reactions were strongest, helping traders anticipate turning points and act faster.

📌 What Does It Do?

These levels are particularly useful for:

- Planning limit orders

- Setting reactive stop-loss or TP zones

- Marking potential areas of price reaction or rejection

🧠 AI-Powered by Baiazuri’s Method

The algorithm is based on a studied replication of Baiazuri’s charting logic, where levels are drawn based on market memory, reaction points, and subtle inefficiencies.

Instead of drawing them manually session after session, Billiard Bands keeps your chart organized and informative without the guesswork.

⚙️ Configurable & Simple

You control how many levels are shown. Whether you’re working with a clean 1-minute chart or a Renko setup, the bands help define where the market is most likely to care about price — and when you should start paying attention.

🔗 Learn More

Use it as part of the OrderFlow X – Algorithmic Master Pack, if you want to combine it with volume-based tools like ATA or Price Action Trail.

Advanced Tick Analyzer (ATA) – Real-Time Volume Intelligence

The Advanced Tick Analyzer (ATA) is one of the flagship tools in the OrderFlow X – Algorithmic Master Pack. It offers a unique perspective on market activity by combining real-time tape reading with volume heat zones, helping traders identify where institutional interest and strong hands are appearing — as it happens.

Continue reading