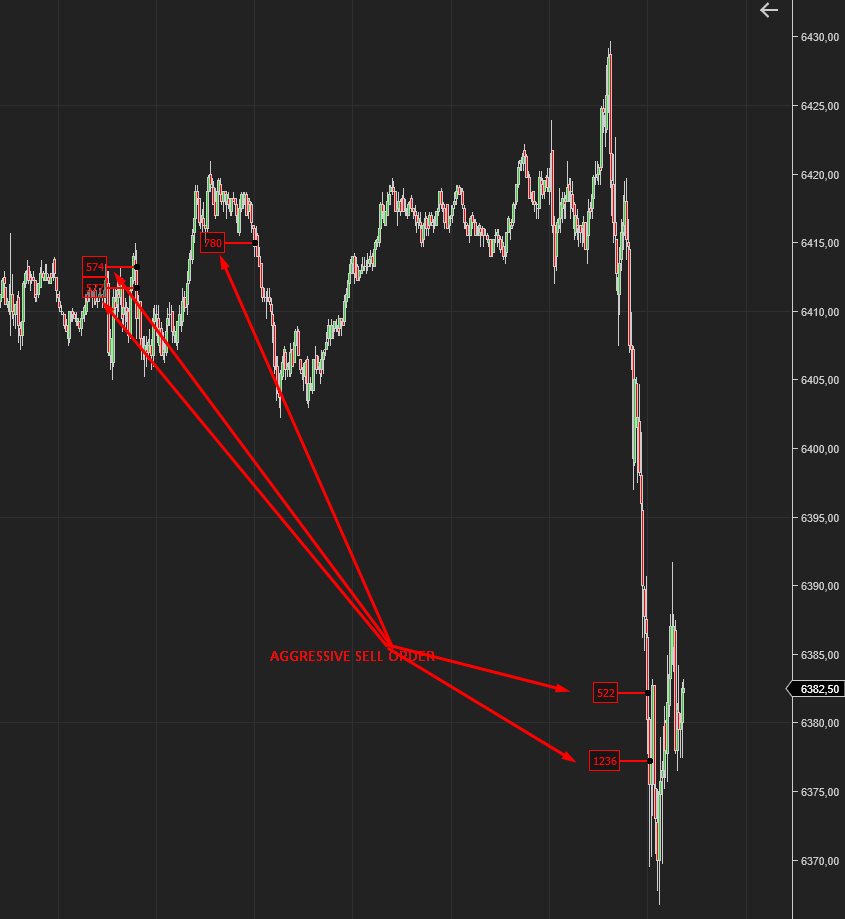

MES-FUTURES SP500

During the RTH session, aggressive selling pressure began to appear in MES (Micro S&P 500), and it intensified during the FED press conference. Early prints of 574 and 780 lots marked the initial wave, followed by heavy prints of 522 and especially 1236 lots during the announcement. This suggests institutional participants were actively selling into the event. Tape indicator confirmed sustained aggression, and the selling pressure is still ongoing with elevated volatility.

During the FED press conference, at the 1.14860 level in EURUSD (6E Futures), an aggressive buy order of 862 lots was met with 846 lots of selling pressure. Based on DOM and tape data, buyers attempted to lift the offer, but sellers responded almost immediately, capping any bullish momentum. This indicates sellers are still present and the market isn’t ready to shift upward decisively.

GC Futures – Order Flow Signal Strategy

Limit Buy vs Aggressive Sell

- A 113-lot limit buy is placed — a passive trader is expecting support at that level.

- Then, a 123-lot aggressive sell hits — a stronger player forces through the bid, overpowering the passive buyer.

This is a classic absorption failure: instead of holding, price breaks down → a sign of seller dominance.

Why It’s Effective

- Many traders treat large limit buys as support.

- But when aggressive orders overwhelm them, it shows urgency and conviction from smart money.

- This traps weak buyers and triggers momentum.

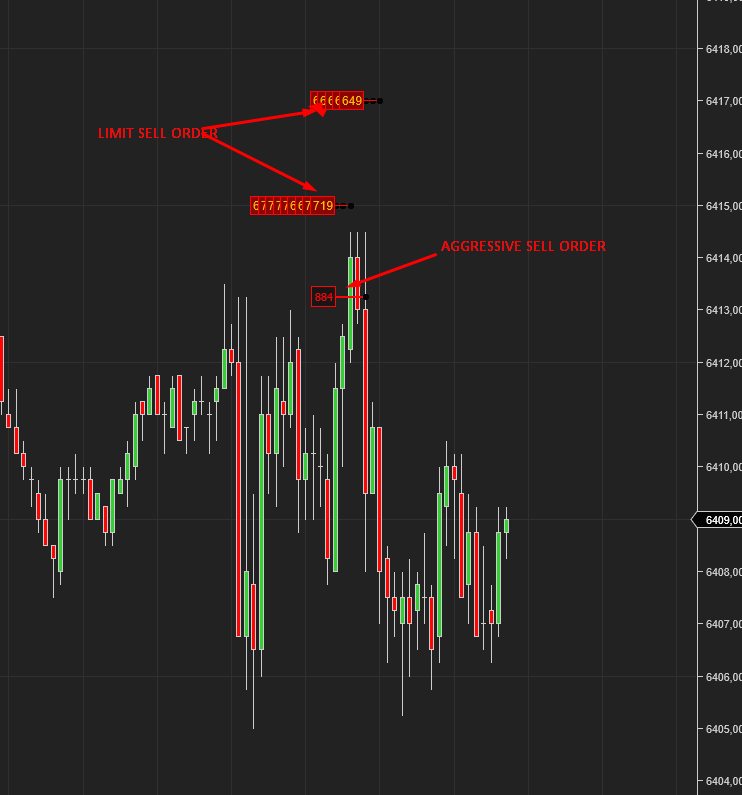

Order Flow Analysis: ES Futures

Limit Sell Orders

- These are passive orders, placed above the current market price, waiting to be filled if the price reaches that level.

- They add liquidity to the market and often act as resistance zones.

- In your chart, we see large blocks of limit sell orders at higher levels (e.g. 6417–6418), suggesting that institutions or traders expect the market to reverse near those levels or are willing to sell there without chasing the price.

No comment yet, add your voice below!