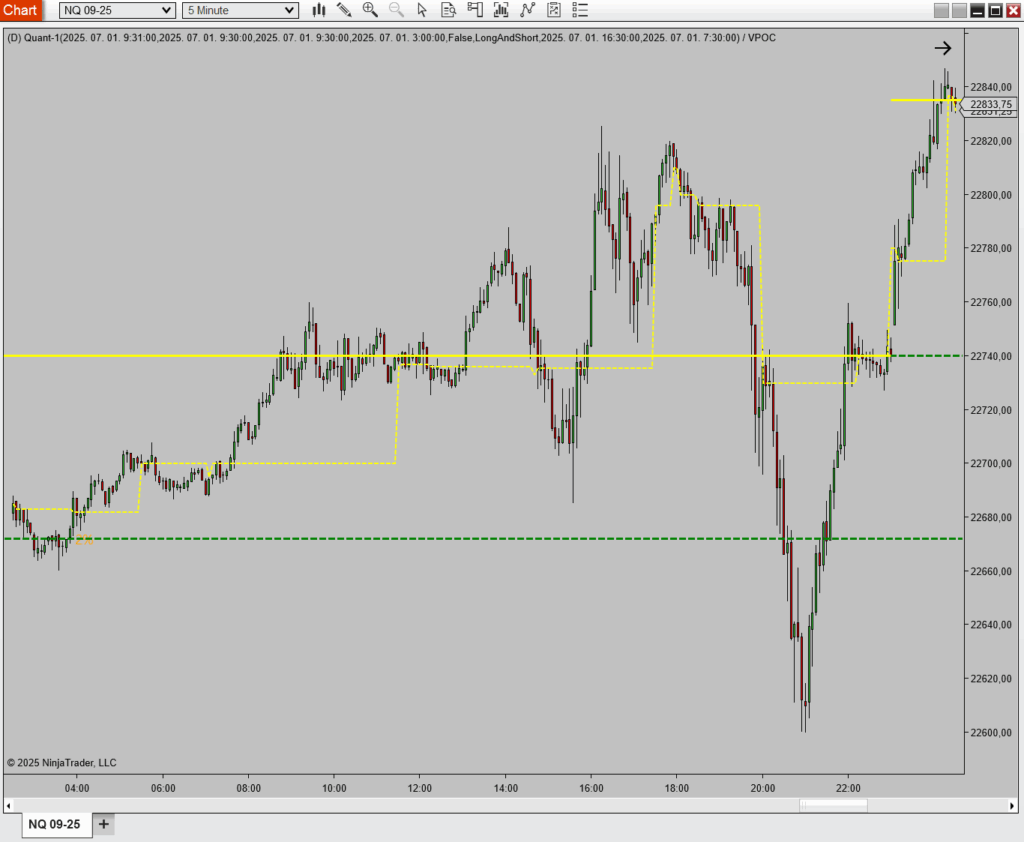

The VPOC (Volume Point of Control) is a classic tool in any volume trader’s arsenal — but this version takes it beyond the standard.

While traditional VPOC indicators rely on static formulas and fixed levels, this enhanced version integrates real-time data analysis and AI-driven insights to show how significant each volume cluster really is — not just where it is.

🧠 What Makes It Different?

Standard VPOC tools simply draw the price level with the most volume for a given day, week, or month — but they don’t tell you how relevant that level is.

This upgraded VPOC:

- Analyzes every tick from the last 365 days in milliseconds

- Compares the current POC level to historical volume behavior at the same time of day

- Displays a percentage score showing how significant the volume is relative to the past year

This lets you instantly judge whether the current POC is weak, normal, or critically important — in real time.

⚙️ Key Features

- 🧠 AI-powered relevance scoring of each VPOC

- 🕒 Choose POC start time (e.g. 00:00 US or 00:00 Madrid)

- 📈 Supports daily, weekly, and monthly VPOC tracking

- 🟢 Shows previous POC levels from past sessions as dashed green lines

- 🔔 Sound + Telegram alerts when the VPOC shifts

- 📷 Telegram screenshots arrive faster than chart render, reducing manual reaction time

🧪 How to Use It

- Use the percentage value to decide if the current VPOC is worth trading off

- Watch how price reacts at highly relevant levels — strong reversals often occur here

- Combine with other tools like ATA, Volume Profile, or Delta Divergence

- Set custom VPOC start times based on your preferred trading session

🧭 Why It Matters

Volume isn’t just about where it happens — it’s about how important that level is in context.

This version of VPOC gives you quantitative insight that transforms a basic tool into a precision-level trade filter.

No comment yet, add your voice below!